How is Housing Affordability Determined?

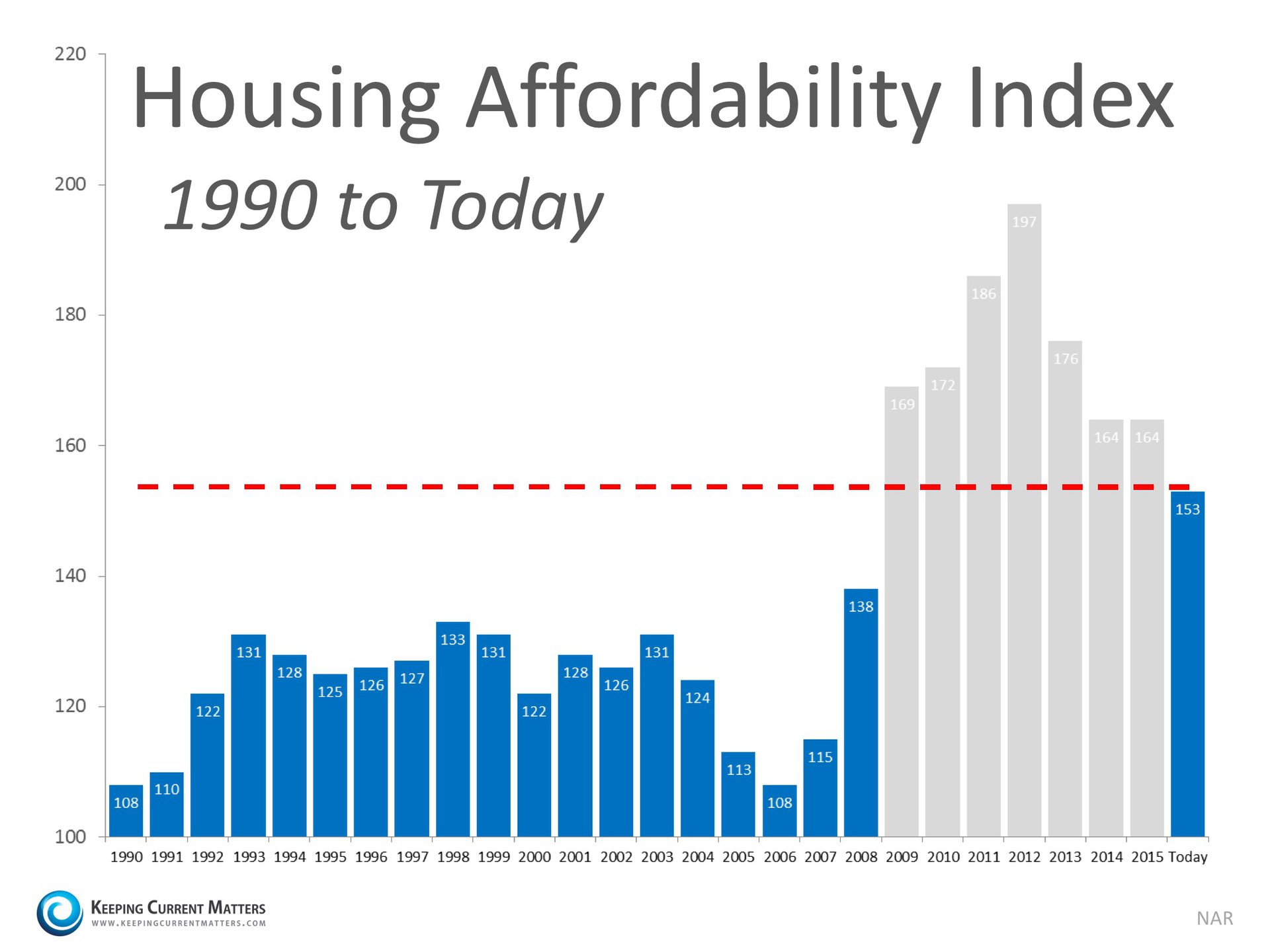

The National Association of Realtors defines the housing affordability index as the measure of "whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data."

Basically, the higher the index the more affordable homes are at the time. "100" seems to be the magic number, alluding that the applicant meets the average income standards and can afford an average priced home.

John Cunius with Alpha Mortgage in Wilmington, NC notes that, "Although there has been a slight drop in affordability in the second quarter of 2016... rising employment, low mortgage rates, and increasing household formations should keep the housing market on a gradual, upward path the rest of the year."

Posted in Buyer Tips, News You Can Use, Team Gale on Sep 01, 2016