-

How is Housing Affordability Determined?

Posted in Buyer Tips, News You Can Use, Team Gale on Sep 01, 2016

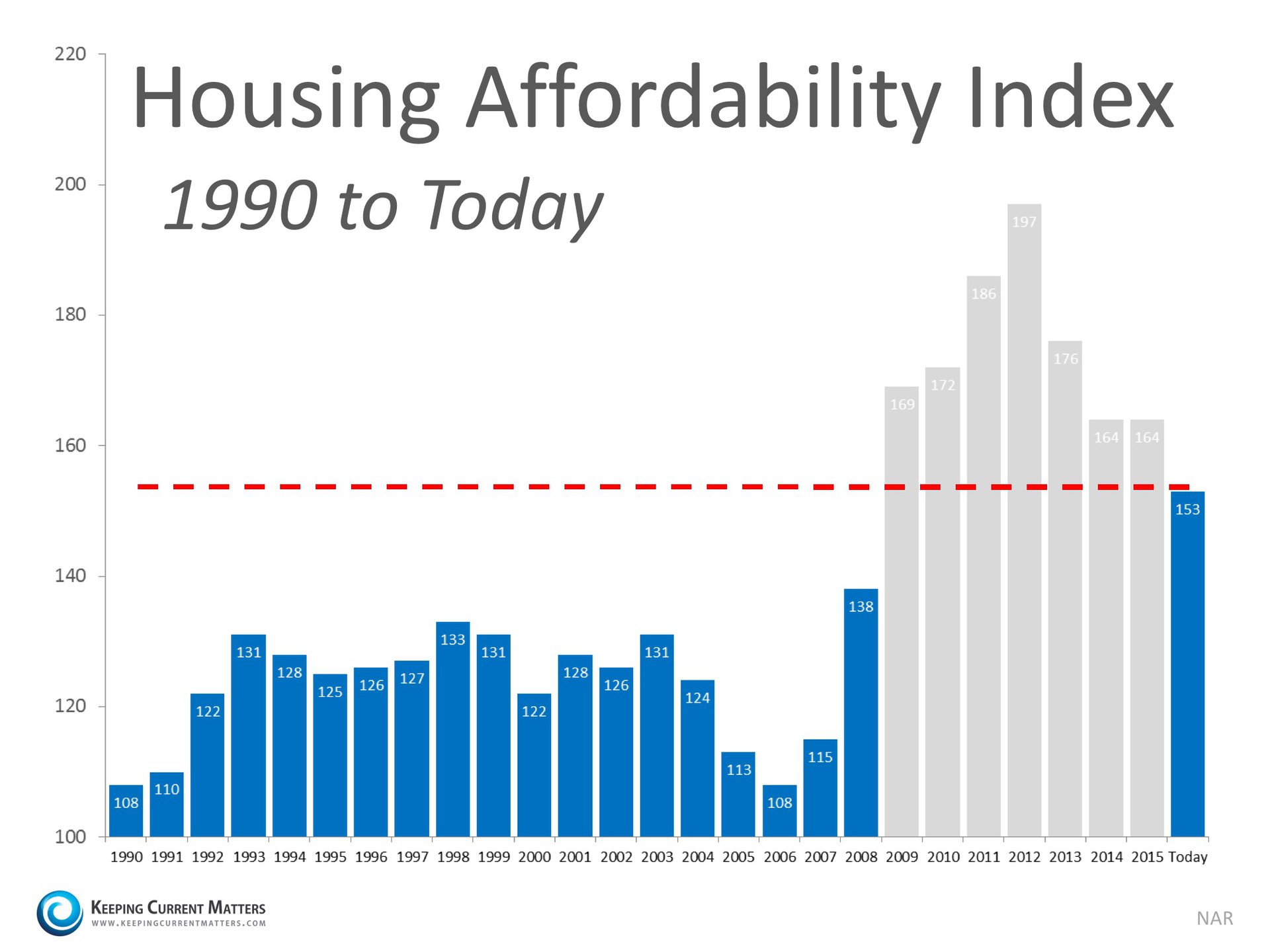

The National Association of Realtors defines the housing affordability index as the measure of "whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data."

Basically, the higher the index the more affordable homes are at the time. "100" seems to be the magic number, alluding that the applicant meets the average income standards and can afford an average priced home.

John Cunius with Alpha Mortgage in Wilmington, NC notes that, "Although there has been a slight drop in affordabilit...

-

Brexit Vote Sends US Mortgage Rates to 3 Year Low

Posted in Buyer Tips, Market Reports, Team Gale on Jul 01, 2016

News outlets this week have been aflutter with speculation in the aftermath of the controversial vote for Britain to leave the European Union. The historic move has many intricacies and consequences on an international plane, which Bloomberg breaks down for us: "Brexit has only heightened concerns about the global economy that have been pushing down borrowing costs since the start of the year."

Keith Gumbinger with HSH.com notes that "the odds for lower rates, for a longer period of time, are very good." The average 30 year mortgage rate has been under 4% since the first quarter of 2016. "If r...

-

Featured Townhome in Westport

Posted in Buyer Tips, Featured Homes series, News You Can Use, Team Gale on May 03, 2016

1109 AVEBURY COURT, WINNABOW, NC 28479

1800 square foot townhome in Westport community, follows "Cambridge II" floor plan from HH Homes. Well-kept brick residence includes three bedrooms, two full baths, private sitting room, and all-season room with heartwood pine ceiling. Living room is open to kitchen, with separate dining area. Stylish details and upgrades include beautiful hardwood flooring, granite counters, breakfast bar, chair rail and accent painting, gas log fireplace.

Westport community offers a swimming pool & clubhouse, as well as playground area. Local dining and daily shopping...

-

Featured Community in Leland

Posted in Buyer Tips, Featured Homes series, Hot Properties of the Week, Team Gale, Video, You're Home with Team Gale Radio on Mar 15, 2016

Things have been progressing at warp speed in Summerlin Trace!

In just about a year's time since Team Gale came on board with Charles David Construction & Capital Growth Properties at this quaint Leland subdivision, we have sold nine homes. Presently there are four properties under contract and four more listings 'active' in the North Carolina Regional MLS.

[caption id="attachment_2570" align="aligncenter" width="759"]

{ Red - Sold; Yellow - Pending; Blue - Active }[/caption]

{ Red - Sold; Yellow - Pending; Blue - Active }[/caption]We only have a handful of lots left! ...

-

Featured Home in Whitney Pines

Posted in Buyer Tips, Featured Homes series, Seller Tips, Team Gale, Video on Feb 25, 2016

2852 VALOR DRIVE, WILMINGTON, NC 28411

Great two bedroom, two bath home for a first time buyer or investor! Located in the Whitney Pines area of upper Wilmington, 2852 Valor Drive is 1,022 sqft on a quarter of an acre. Common area is an "L" shape, with combination living/dining space open to kitchen with large pantry. Master bedroom is 14x11' with attached bath, including wide vanity and upgraded shower head. Living room lay between master and second bedroom and bath for a little privacy from roommates or guests. Storage shouldn't be an issue here, with several closets throughout the home and ...

-

Never Move Without...

Posted in Buyer Tips, Seller Tips, Team Gale on Oct 21, 2015

...Team Gale! We kid, we kid. But really, folks, we're your best bet for every aspect of real estate in southeastern NC.

Buying a home is among the greatest financial investments you will make in your life, and moving is among the most stressful. There are several items to make sure you have ahead of a move, whether it's across town or across the country!

WorkHacks blogger Julia Roy moved with her husband from New York City to San Diego last spring. The productivity queen weighed her options on how best to move their entire lives from one coast to another, finally settling on the PODS company ...

-

Moving Tips: Make Unpacking Less Daunting

Posted in Buyer Tips, News You Can Use, Team Gale on Sep 23, 2015

Coldwell Banker Blue Matter has articles on everything from kitchen updates to ideas for holiday decorating to understanding real estate jargon.

Contributor Lindsey Chamberlain shared some tips for de-stressing the process of unpacking in your new place. Read her complete list here.

-

Clean your home or apartment before you move in! Areas like the kitchen and bathroom will be so much easier to clean without a clutter of boxes. Set aside some time to give the important areas of your new home a thorough once-over.

-

Your movers and helpers are likely to be way more enthusiastic and limber at th...

-

-

Common Missteps in House Hunting

Posted in Buyer Tips, News You Can Use, Team Gale on Sep 16, 2015

Before you dedicate every Saturday to hitting as many open houses as your city holds, you need to know what you're looking for. If your Trulia search produced over a hundred results, you may lack focus in your "wants" and "needs" criteria which will make your eventual house hunt increasingly frustrating.

Making sure you are informed before entering into the search process will help you narrow what you're looking for and get to the offer stage more quickly.

Here are five tips from Team Gale to help you as you set off on your journey to homeownership!

-

Shopping for a home before you know how mu...

-

-

Demystifying The Refinance Process

Posted in Buyer Tips, News You Can Use, Seller Tips, Team Gale on Aug 10, 2015

Markets across the nation have rebounded from the burst bubble of '08, with more and more homeowners proactively trying to optimize and stabilize their assets. Home ownership is one of the most, if not the most, important investment a person or family can make. If you plan to stay in your home for some time, refinancing is responsible; as it provides the opportunity to assess the value of your home, clarify your equity, and potentially save you money on your outstanding mortgage payments. One issue associated with refinancing that always hangs people up is whether it costs anything to explore....

-

You're Home with Team Gale - Affordable Housing

Posted in Buyer Tips, Team Gale, You're Home with Team Gale Radio on May 18, 2015

Jody Wainio from Buyer Choice Realty sat down with Tom Gale on the "You're Home" show this weekend to talk about affordable housing options in New Hanover County.

Wainio has been involved with affordable housing since 2005, serving on various committees and boards. Wainio was quick to point out that "affordable housing" has become synonymous with "public housing," though they are quite different. The earmark for a "burdened" homeowner is anyone who shells out more than 30% of their annual income to mortgage, insurance, and property maintenance.

The pair discussed the 16-hour "Workforce Housing...

-

Team Gale

420

-

Jacksonville NC Real Estate

59

-

Featured Homes series

308

-

Foreclosures in SE NC

73

-

Buyer Tips

33

-

Local Business Profile

21

-

Seller Tips

30

-

Video

26

-

Events In Our Area

42

-

Wilmington NC Real Estate

120

-

Home Improvement

11

-

News You Can Use

59

-

Hampstead NC Real Estate

26

-

Hot Properties of the Week

69

-

Leland NC Real Estate

44

-

You're Home with Team Gale Radio

45

-

Market Reports

18

-

Open House

14

-

Whiteville NC Real Estate

4

-

Southport NC Real Estate

18

-

Shallotte NC Real Estate

24

-

Wallace NC Real Estate

7